In recent years, Non-Fungible Tokens (NFTs) have taken the world by storm. These unique digital assets, which can represent anything from artwork and music to virtual real estate and collectibles, have captured the attention of investors, creators, and collectors alike. As the NFT market continues to grow and mature, a new trend has emerged: NFT lending. This innovative financial service allows NFT holders to unlock the value of their digital assets without selling them outright.

The concept of NFT lending is still relatively new and can be confusing for those who are not familiar with the world of cryptocurrencies and decentralized finance (DeFi). In this article, we will dive deep into the mechanics of NFT lending, exploring how it works, its benefits, and the potential risks involved.

Whether you’re an experienced Web3 professional or new to the world of NFTs and DeFi, this guide will provide you with a comprehensive understanding of NFT lending and its potential impact on the future of finance.

Table of Contents

ToggleWhat is NFT Lending?

NFT lending, is an important part of NFT Financing (or NFT-Fi), is a financial service that allows NFT holders to use their NFTs as collateral to borrow money. Similar to traditional secured lending like a mortgage, NFT loans enable borrowers to access liquidity without selling their digital assets.

NFT lending platforms, like NFTfi and Arcade, create an open and decentralized marketplace where NFT owners can list their digital assets as collateral and receive offers from lenders, who are happy to lend their cash out to earn a return (interest) on that capital. The loan amount is typically a percentage of the NFT’s value, determined by factors such as market demand and liquidity. Upon accepting a loan offer, the borrower receives funds in cryptocurrency, while the NFT is held in a smart contract until repayment.

The Role of Smart Contracts in NFT Lending

Smart contracts are a crucial innovation that sets NFT lending apart from traditional lending and enables NFT-Fi to operate in a decentralized and trustless manner. These self-executing contracts, running on blockchain technology, automatically enforce loan terms without the need for intermediaries. Smart contracts provide a range of benefits for both borrowers and lenders including:

- Automation: Smart contracts automatically manage loan disbursement, collateral locking, and repayment processes, reducing human error and streamlining operations.

- Transparency: All terms and transactions are recorded on the blockchain, providing full visibility to both lenders and borrowers.

- Security: The immutable nature of blockchain ensures that loan terms cannot be altered once agreed upon, protecting both parties from fraud.

- Trustless transactions: Parties can engage in lending activities without needing to trust each other or a central authority, as the smart contract impartially enforces the agreed-upon terms.

Smart contracts are a key difference between NFT lending and traditional lending that allow NFT-Fi to exist in a decentralized and trustless way. They ensure the safekeeping of collateral during the loan period and seamlessly return it to the borrower upon repayment, or to the lender in the case of a default. This automation streamlines the lending process and reduces the need for intermediaries.

NFT financing offers advantages like providing liquidity to NFT holders without requiring them to sell their assets and creating opportunities for lenders to earn interest in a less risky way compared to other DeFi lending opportunities. However, NFT lending is still a nascent industry with risks, including NFT value volatility and an evolving legal and regulatory framework.

Despite these challenges, NFT lending represents an exciting development in decentralized finance (DeFi), offering new opportunities for both NFT holders and lenders.

The Role of Tokenization in NFT Lending

Tokenization is the process of creating a digital representation of an asset on a blockchain, which enables their use as collateral in decentralized finance (DeFi). . By tokenizing assets like real estate, artwork, or even fine wines, companies can create NFTs that represent ownership of real world assets, which in the case of NFT-Fi provides a much more stable and secure form of collateral compared to purely digital NFTs.

One example of the tokenization of RWAs in action is GrtWines, which creates wine-backed NFTs by tokenizing high-value wines and storing them in optimal conditions until the NFT holder decides to redeem the NFT for the physical bottle – in this case you can think of the NFT acting as a coupon or certificate of ownership for the physical bottles. These NFTs can then be used as collateral for loans on NFT lending platforms, offering a more tangible and stable backing compared to other digital collectibles for lenders. If this sounds like something you’d be interested in check out the Grtwines marketplace!

GrtWines’ wine backed-NFTs have been used as collateral to facilitate loans on NFTfi

By creating a digital market for tokenized assets, buyers and sellers can easily trade them, this increased liquidity can lead to more efficient price discovery and better risk management for both lenders and borrowers.

As the world of NFT lending continues to evolve, the role of tokenization in bridging the gap between physical assets and digital finance is set to become increasingly important. The ability to tokenize a wide range of real-world assets opens up new possibilities for NFT-backed loans, providing a more diverse and stable pool of collateral for lenders and borrowers alike.

How Does NFT Lending Work?

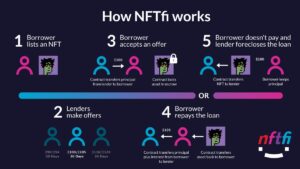

NFT lending platforms like NFTfi and Arcade connect NFT owners looking to borrow money with lenders willing to provide capital. The process is relatively simple:

- The borrower lists their NFT on the lending platform and sets the desired loan terms, such as the desired amount, interest rate, and duration.

- Lenders review the NFT and loan terms, and if they agree, they make an offer.

- If the borrower accepts the offer, the smart contract takes custody over the NFT until the end of the loan term. .

- The smart contract automatically executes the loan agreement, ensuring the NFT is returned to the borrower once the loan is repaid with interest. Or in the case of default the smart contract will send the NFT to the lender.

Smart contracts eliminate the need for intermediaries, reduce the risk of fraud, and provide transparency, as the loan terms are recorded on the blockchain and cannot be altered.

This infographic from NTFfi showcases how NFT lending on the platform works in practice.

The loan amount is determined by a Loan-to-Value (LTV) ratio, which represents the percentage of the NFT’s value that can be borrowed. For example, if an NFT has a market value of $10,000 and the lender agrees to an LTV of 50%, the borrower can receive a loan of up to $5,000. The LTV ratio helps to manage risk for lenders by ensuring that the loan amount is proportional to the value of the collateral and ensures that in the case of default they can easily liquidate (sell) the asset and cover the amount that was lent.

As the NFT lending market matures, we can expect to see more sophisticated solutions emerge, such as pooled lending and insurance products to protect against potential loss of value in the collateral NFT.

The Benefits of NFT Financing

NFT financing offers several compelling benefits for both borrowers and lenders, making it an attractive option in the decentralized finance (DeFi) space.

The Benefits For Borrowers:

- Access to Liquidity One of the primary benefits of NFT lending for borrowers is the ability to access liquidity without having to sell their digital assets. This is particularly useful for NFT owners who believe in the long-term value appreciation of their assets or have sentimental attachments to their digital collectibles. By using their NFTs as collateral, borrowers can unlock the monetary value of their assets while still maintaining ownership.

- Lower Interest Rates Another advantage of NFT financing for borrowers is the potential for lower interest rates compared to traditional unsecured loans. Since NFTs serve as collateral, lenders face less risk and may offer more competitive interest rates. This can make NFT lending an attractive option for borrowers who need access to funds but want to avoid high-interest unsecured loans.

- Increased Access to Credit NFT lending has the potential to democratize access to credit by providing a new avenue for borrowers who may not have access to traditional financing options. As the NFT market grows and more people invest in digital assets, NFT financing could become an increasingly important source of liquidity and financial inclusion.

The Benefits For Lenders:

- Earning Interest on Cryptocurrency NFT financing presents an opportunity for lenders to earn interest on their cryptocurrency holdings. By providing loans backed by NFTs, lenders can potentially earn higher returns compared to traditional savings accounts or other low-yield investments.

- Portfolio Diversification Lending against NFTs allows investors to diversify their investment portfolios beyond traditional assets. As the NFT market continues to grow, NFT financing can provide exposure to a new asset class with potentially attractive returns.

- Reduced Risk through Collateralization The use of NFTs as collateral in NFT lending helps to reduce the risk of default for lenders. If a borrower fails to repay the loan, the lender can claim the collateralized NFT to recoup their investment. Additionally, the use of smart contracts in NFT lending can automate the loan process and provide added security for lenders.

Risks and Considerations in NFT Lending

While NFT financing offers benefits, borrowers and lenders should be aware of potential risks and considerations.

NFT Value Volatility

The NFT market can be volatile, with significant fluctuations in NFT value over short periods. When using NFTs as collateral for loans, borrowers may need to provide additional collateral if the NFT’s value decreases, or risk liquidation. Lenders should consider market volatility when determining loan-to-value (LTV) ratios for NFT collateral loans and be aware of potential losses if the borrower defaults due to decreased NFT value.

The above data from Cryptoslate shows the volatile nature of the NFT market of the past.

Loan Terms and Conditions

Before agreeing to an NFT-backed loan, borrowers must understand the interest rate, repayment schedule, fees, and default consequences, such as losing the collateralized NFT. Both borrowers and lenders should fully understand all aspects of the loan including the repayment schedule, what happens in the case of default, and the interest rate. Be sure to do your research before engaging in any transactions to see if the terms make sense for your situation.

Regulatory and Tax Considerations

The regulatory landscape for NFTs and NFT lending is evolving. Borrowers and lenders should be aware of legal and regulatory requirements in their jurisdiction and ensure compliance. Tax implications of NFT loans may vary by jurisdiction and loan terms.

By understanding these risks and considerations, participants can make informed decisions when engaging in NFT lending and borrowing.

The Future of NFT Lending

As the NFT market matures and decentralized finance (DeFi) continues to gain mainstream traction, the future of NFT lending appears promising, with plenty of potential for innovation and growth. Here’s just a few key areas where we’re likely to see further development in NFT lending.

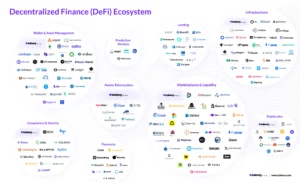

Integration with DeFi

One area of growth is the integration of NFT financing with other DeFi applications, such as yield farming and liquidity mining. Combining NFT collateral loans with other DeFi mechanisms could offer users additional rewards and incentives for participating in NFT lending and borrowing.

The DeFi ecosystem is comprehensive as showcase by the above image created by Tokeny.

Risk Assessment and Management

As the NFT lending market grows, we may see the development of sophisticated risk assessment and management tools, such as machine learning algorithms to analyze NFT value and volatility, and insurance products to protect against potential losses.

Regulatory Framework

The future of NFT financing also depends on the development of a clear and supportive regulatory framework. Establishing guidelines and best practices will be crucial to ensure the stability and integrity of the NFT lending market.

Explore the unique intersection of NFT lending and fine wine investments with GrtWines. Our platform offers wine-backed NFTs, combining the potential of digital assets with the timeless value of fine wines. Whether you’re an NFT enthusiast or a wine connoisseur, GrtWines provides an innovative way to diversify your portfolio. Visit our marketplace to see some of the amazing wines we have on offer.