For wine enthusiasts and collectors looking to deepen their knowledge and expertise in the industry, the term “en primeur” is essential to understand. Also known as “wine futures,” en primeur refers to the process of buying wines while they are still in the barrel, before they are bottled and released to the market. This system, most commonly associated with the prestigious wines of Bordeaux, offers buyers the opportunity to secure highly sought-after bottles at potentially lower prices. However, buying en primeur also comes with its own set of risks and challenges.

In this comprehensive guide, we will delve into the world of en primeur, exploring its history, the process involved, and the benefits and drawbacks of investing in wine futures. By the end of this article, you’ll have a clearer understanding of what it means to buy wine en primeur and whether it’s a suitable option for you.

Table of Contents

Toggle

What is En Primeur?

En primeur is a method of purchasing wines while they are still aging in the barrel, typically 12 to 18 months before they are bottled and released to the market. When you buy a wine en primeur, you are essentially purchasing a promise from the winery to deliver the wine once it is ready.

Wines still aging in the barrel and available for purchase en primeur.

When you purchase a bottle of wine from a retail store or restaurant, the wine has already reached a state of maturity and is ready to drink or store in your cellar.

The en primeur process is most closely associated with the wines of Bordeaux, where it has been a long-standing tradition. However, other wine regions, such as Burgundy, the Rhône Valley, and Port, also offer wines en primeur. It has become an important way for wineries to promote their new vintages and for enthusiasts to get an early sample of upcoming wines.

The History of En Primeur

The origins of the en primeur system can be traced back to the 18th century in Bordeaux, France. At the time, British and Dutch wine merchants would visit the region’s châteaux to taste the young wines still aging in barrels. They would then purchase the wines they believed showed the most promise, with the intention of selling them to their customers once the wines were bottled and shipped.

Château Lafite Rothschild in the early 20th century when the En Primeur process was first gaining popularity.

This practice became more formalized in the 1920s and 1930s, as the Bordeaux wine trade began to structure itself around the en primeur system. Négociants, who act as intermediaries between the châteaux and the buyers, would purchase the wines en primeur and then sell them to retailers and private customers around the world.

The modern en primeur system took shape in the 1970s, with the rise of influential wine critics such as Robert Parker. These critics would visit Bordeaux during the spring following the harvest to taste the young wines and assess their potential. Their scores and tasting notes would then be published, influencing the demand and prices for the wines being sold en primeur.

Over time, the en primeur system has evolved and expanded, with other wine regions adopting similar practices. Today, buying en primeur remains an important aspect of the fine wine market, offering collectors and enthusiasts the opportunity to secure highly sought-after bottles before they are released to the general public.

How the En Primeur Buying Process Works

While the en primeur process is most closely associated with Bordeaux, it is also practiced in other wine regions such as Burgundy, the Rhône Valley, and Port. The process typically takes place in the spring following the harvest, though the exact timing may vary depending on the region and the vintage.

During the en primeur campaign, wine professionals, including critics, journalists, and négociants, are invited to taste the young wines from the most recent vintage. These tastings, known as “barrel tastings,” provide a first glimpse into the potential quality and character of the wines.

Critics will assess the wines and publish their tasting notes and scores. In Bordeaux, influential critics such as Robert Parker, James Suckling, and Jancis Robinson play a significant role in generating interest and demand for the wines and can greatly influence Bordeaux en primeur prices. In other regions, local critics and wine publications may have a more prominent voice.

Following the barrel tastings, the châteaux or wineries will set their en primeur prices based on the quality of the vintage, the feedback from critics, and market demand. Typically, négociants will then purchase the wines at the offered prices and sell them to retailers and private customers around the world.

By participating in the en primeur process, buyers have the opportunity to secure wines that may be in high demand and potentially benefit from price appreciation. However, it is important to note that buying en primeur also comes with risks, as it’s difficult to assess the future quality of a wine from the initial barrel tastings, and market fluctuations can impact the value of the investment. En primeur wines are also typically held for longer periods, so investments may only prove lucrative after 10-20 years.

The Benefits of Buying En Primeur

Buying wine en primeur offers several compelling benefits for wine enthusiasts and collectors. Some of the key advantages include:

- Securing highly sought-after wines: En primeur allows buyers to secure wines that may be in high demand and have limited production. By purchasing these wines before they are bottled and released, buyers can ensure they have access to rare and prestigious bottles that may be difficult to obtain later on.

- Potential for price appreciation: Wines purchased en primeur are often priced lower than they would be upon release. If the vintage proves to be of exceptional quality or demand for the wine increases, the value of the wine may appreciate over time, offering a potential return on investment for the buyer.

- Guaranteeing provenance and storage conditions: When purchasing wines en primeur, buyers can be assured of the wine’s provenance, as it is coming directly from the château or winery. Additionally, buyers can control the storage conditions of the wine from the moment it is bottled, ensuring that it is properly handled and aged until it is ready to drink.

- Access to large quantities: Buying en primeur is one of the only ways to secure large quantities of specific wines. If a collector or investor wants to purchase a significant number of bottles, such as 100 or more, the en primeur system provides an opportunity to do so that might not be available once the wine is released to the general market.

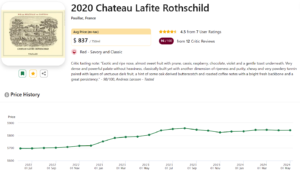

The above-listed bottle of 2020 Château Lafite Rothschild saw an over 20% price increase since its release in July 2022. [Source]

While these benefits make buying en primeur an attractive option for many wine enthusiasts, it’s important to be aware of the potential challenges and risks involved. In the next section, we will explore some of the drawbacks and considerations to keep in mind when purchasing wines en primeur.

The Challenges of Buying Wine En Primeur

While buying wine en primeur can be an exciting and rewarding experience for wine enthusiasts, it is important to be aware of the potential challenges and risks involved. Some of the main drawbacks to consider include:

- Uncertainty about the final quality of the wine: En primeur purchases are based on barrel tastings of young, unfinished wines. While experienced critics and tasters can provide valuable insights, the final quality of the wine may differ from initial assessments. Factors such as the wine’s evolution during aging, bottling conditions, and storage can all impact the finished product.

- Potential for price fluctuations and market speculation: The value of wines purchased en primeur can be subject to market fluctuations and speculation. If a vintage is initially hyped but fails to live up to expectations, or if market demand shifts, buyers may find the value of their investment decreasing.

- Storage and insurance: Once the wines are bottled and released, buyers must arrange for proper storage and insurance. This often involves renting space in a temperature-controlled wine storage facility and insuring the collection against potential losses or damages. These additional costs should be factored into the overall investment.

- VAT and duty costs: When buying wine en primeur, it’s important to consider the additional costs of VAT (Value Added Tax) and duty. These taxes can significantly impact the overall cost of your purchase, especially if you’re importing wines from abroad. Rates differ from country to country so be sure to be aware of these rates prior to making a purchase.

Storing your wines in proper facilities ensures that they maintain their value, quality, and condition.

Despite these challenges, many wine enthusiasts find that the benefits of buying en primeur outweigh the risks. By carefully researching the wines, vintages, and market conditions, and working with reputable professionals, buyers can make informed decisions and build valuable collections over time.

Things to Keep in Mind When Buying En Primeur

Buying wine en primeur can be a complex and challenging process, but with the right knowledge and strategies, it can also be a rewarding and enjoyable experience. To help ensure success when investing in en primeur, consider the following key tips and best practices:

Buying wine en primeur can be a complex and challenging process, but with the right knowledge and strategies, it can also be a rewarding and enjoyable experience. To help ensure success when investing in en primeur, consider the following key tips and best practices.

Researching and Following Reputable Wine Critics

When considering buying wine en primeur, it’s essential to stay informed about the latest vintage assessments and tasting notes from respected wine critics. Look for consistent opinions across multiple sources to get a well-rounded view of the vintage’s potential. Following critics who specialize in the regions or styles you’re interested in can help you make more informed decisions.

Understanding the Risks and Benefits of En Primeur

Before investing in en primeur, make sure you have a clear understanding of the potential risks and rewards involved. Consider your financial situation, investment goals, and personal wine preferences when deciding whether en primeur is right for you. Evaluate the potential for price appreciation, but also be aware of the possibility of price fluctuations and the challenges of reselling wines if needed. Secondary markets for wine are still relatively underdeveloped, which is one of the challenges we aim to solve here at GrtWines.

Choosing a Trusted Retailer or Négociant

Working with reputable wine retailers or négociants, who have experience with the en primeur market is crucial. Négociants, like CVBG shown below, can be crucial in providing valuable guidance and helping you to secure allocations of sought-after wines. Look for retailers or négociants with a proven track record, strong relationships with producers, and a commitment to customer service. Don’t hesitate to ask questions and seek advice to ensure you’re making informed decisions.

Planning for Proper Storage and Insurance

Once your en primeur wines are bottled and released, it’s important to have a plan in place for proper storage and insurance. If you don’t have a suitable home storage solution, consider renting space in a professional wine storage facility that offers temperature and humidity control, security, and inventory management. Be sure to also insure your collection against potential losses or damages, and keep detailed records of your purchases and valuations. Proper storage and insurance will help protect your investment and ensure your wines are in optimal condition when you’re ready to enjoy them.

By following these tips and strategies, you can navigate the en primeur market with greater confidence and increase your chances of building a successful and rewarding wine collection over time.

Get Started with Your En Primeur Journey

Ultimately, whether buying en primeur is right for you will depend on your individual goals, preferences, and risk tolerance. If you’re passionate about wine, enjoy the thrill of the hunt, and have the patience and resources to invest in the long term, en primeur can be a rewarding and exciting way to build your collection.

As you navigate the en primeur market, remember to stay informed, work with trusted professionals, and always keep your personal tastes and objectives in mind. With careful research, a strategic approach, and a bit of luck, you may find yourself with a cellar full of treasured bottles that appreciate in both value and quality over time.

If you’re looking to get started with En Primeur you can check out the options available on GrtWines, where we offer a curated selection of premium en primeur wines sourced through our partnership with one of the leading negociants in the bordeaux region, CVBG. Click here to see our full collection.