- Real World Assets (RWA) are physical assets that are represented by digital tokens on a blockchain, most commonly in the form of Non-Fungible Tokens (NFTs). This innovative concept has gained significant traction in recent years, as it combines the benefits of digital ownership with the stability and tangible value of physical assets.

- By representing physical assets as NFTs, RWAs enable secure and transparent trading, as well as the ability to track the provenance and ownership history of the underlying assets.

Table of Contents

Toggle

The Concept of Real World Assets

Real World Assets work by creating a digital representation of a physical asset on a blockchain, such as a piece of fine art. This is typically achieved through the use of NFTs, which are unique, indivisible, and immutable tokens that contain metadata about the underlying asset. The metadata can include information such as the asset’s description, ownership history, and authenticity certificates.

These new digital assets are growing quickly, so read on to learn more about the benefits of this potential new asset class:

Increased Liquidity

Traditionally, most real-world assets have been considered illiquid, meaning they cannot be easily bought, sold, or traded. This is often due to factors such as high transaction costs, a limited number of marketplaces, and the physical nature of the assets. By tokenizing these assets and representing them as NFTs, RWAs can be traded on digital platforms with greater ease and efficiency.

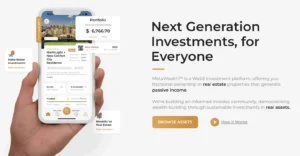

This increased liquidity makes the assets more accessible to a wider range of investors and can potentially lead to more accurate price discovery. For example, companies like MetaWealth (shown below) are building a digital marketplace to trade tokens backed by fractionalized real estate, making real estate more accessible to everyday investors and boosting liquidity in the market.

Enhanced Security and Transparency

One of the key advantages of blockchain technology is its ability to provide a secure and transparent record of transactions. When real-world assets are represented as NFTs on a blockchain, the ownership and transfer of these assets are recorded on an immutable and tamper-proof ledger.

This reduces the risk of fraud, disputes, and unauthorized transactions. Furthermore, the transparency of the blockchain allows all participants to view the ownership history and provenance of the asset, increasing trust and confidence.

Improved Accessibility

Many real-world assets, such as real estate or fine art, have traditionally been accessible only to wealthy individuals or institutional investors due to high capital requirements and other barriers to entry. One of the benefits of RWAs is that it enables the fractionalization of assets, allowing single assets to be broken down into smaller sizes.

Fractionalized RWAs can help to democratize access to these investment opportunities, allowing investors to purchase smaller shares of the asset, making it more affordable and accessible to a broader range of people. This improved accessibility can lead to greater market participation and potentially more stable prices.

Reduced Costs and Complexity

Owning and managing physical assets can come with significant costs and complexities, such as storage, insurance, maintenance, and legal fees. Tokenizing real-world assets can help reduce some of these costs and streamline the ownership process.

For example, by holding a token representing a share of a real estate property, an investor can benefit from the property’s appreciation without worrying about the day-to-day responsibilities of owning a property. Similarly, tokenizing assets like precious metals or fine wines can eliminate the need for individual investors to handle storage and security, as these responsibilities can be delegated to trusted third parties.

Real World Assets in the Real World

Real World Assets span a wide range of industries and asset types, offering investors diverse opportunities to invest in physical assets through digital tokens. Some common examples of RWAs include:

Precious Metals

While investors can gain exposure to precious metals like gold and silver through traditional financial instruments such as ETFs, futures, and options, tokenized precious metals offer a few distinct advantages. Tokenization allows for fractional ownership, enabling investors to purchase smaller amounts of these assets. This can be particularly beneficial for retail investors who might want to commit large amounts to gain some exposure to precious metals.

Additionally, tokenized precious metals can be easily integrated into De-Fi platforms, allowing investors to use their holdings as collateral for loans and unlock their invested capital.

Real Estate

Tokenized real estate assets offer several advantages over traditional real estate investments, such as buying property directly or investing in REITs. While direct property ownership can be costly and illiquid, and REITs may have limited transparency, tokenized real estate lowers the barrier to entry by enabling fractional ownership.

As with precious metals this allows investors to gain exposure to real estate with a smaller capital outlay and provides greater liquidity through secondary market trading. Tokenized real estate also enables investors to create customized portfolios tailored to their specific strategies and risk preferences, an option not readily available with traditional real estate investment vehicles.

Art, Fine Wine, and Collectibles

Traditionally, high costs, limited accessibility, and lack of transparency have been significant barriers to investors looking to gain exposure to the fine arts and collectibles market. Tokenization of these assets provides enhanced liquidity, enabling investors to easily enter or exit positions, while improving price discovery and market efficiency. Storing ownership and provenance information on the blockchain also helps to bolster security and authenticity, mitigating risks such as forgeries and fraud.

Tokenizing fine wine, in particular, can help address challenges such as proper storage, authentication, and insurance. By holding wine-backed tokens, like those offered by GrtWines, investors can gain exposure to this asset class without the complexities of physical ownership, while still having the option to redeem the token for the actual bottle if desired.

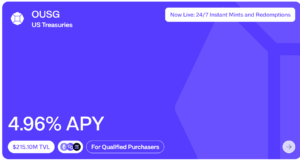

Tokenized Treasuries & Bonds

Tokenized treasuries, or tokenized government bonds, have emerged as an important example of Real World Assets in recent years. By tokenizing bonds on a blockchain, investors can gain exposure to government debt securities with the added benefits of increased liquidity, fractional ownership, and faster settlement times.

Tokenized treasuries are expected to greatly improve access to government bonds, which have traditionally been accessible primarily to institutional investors. Through tokenization, retail investors can participate in this market with smaller investment amounts, diversifying their portfolios and benefiting from the stability and yield potential of government-backed securities.

De-Fi, DePIN, and the Role of Real World Assets

The rise of Real World Assets has been closely tied to the growth of Decentralized Finance (De-Fi) and Decentralized Physical Infrastructure Networks (DePIN). These innovative technologies are reshaping the financial landscape and creating new opportunities for investors and asset owners alike.

Decentralized Finance (De-Fi) and RWAs

De-Fi refers to a new generation of financial applications and services that operate on blockchain networks, enabling users to access a wide range of financial products and services without the need for traditional intermediaries like banks or brokerages. These applications are primarily focused around decentralized exchanges and borrow/lend platforms. Real world assets can provide more stability for these markets by allowing traders to buy, sell, and lend tangible goods, as opposed to previously when they relied solely on cryptocurrencies like ETH.

Real World Assets play a crucial role in the De-Fi ecosystem by providing a bridge between the digital and physical worlds. By tokenizing real-world assets and making them available on De-Fi platforms, investors can use these assets as collateral for loans or trade them on decentralized exchanges. This integration of RWAs into De-Fi unlocks new opportunities for investors and helps to bring greater stability and diversity to the ecosystem.

As of May 2024, there was over USD $4B worth of RWAs in total asset value locked (TVL) in DeFi protocols, according to DeFiLama. As showcased in the chart above, the growth in the RWA space has been extraordinary, leading many too believe it has the potential to disrupt the worlds of both DeFi and traditional finance.

Decentralized Physical Infrastructure Networks (DePIN)

DePIN is an emerging concept that focuses on creating decentralized networks for the management and exchange of physical assets. These networks leverage blockchain technology and IoT devices to create a transparent and efficient system for tracking, verifying, and trading real-world assets.

In a DePIN environment, physical assets are equipped with IoT devices that record data about an asset’s condition, location, and ownership. This data is then stored on a blockchain, creating an immutable record of the asset’s history and provenance. By using smart contracts and tokenization, these assets can be easily traded or used as collateral in financial transactions.

The integration of Real World Assets into DePIN has the potential to revolutionize supply chain management, logistics, and trade finance. For example, tokenized commodities can be tracked from production to delivery, ensuring transparency and reducing the risk of fraud or counterfeiting. This is particularly important for the wine industry, with the counterfeit industry for wines being estimated to be worth over $65 billion. With advances in DePIN and logistics technology the world may finally make meaningful progress on shutting down counterfeiters and improving trust in secondary markets.

The Future of Real World Assets

As the world continues to embrace digital transformation and the adoption of blockchain technology accelerates, the future of real world assets looks increasingly promising. The tokenization of real-world assets has the potential to revolutionize the way we invest, trade, and manage physical assets, creating a more accessible, transparent, and efficient global marketplace. Digital asset manager, 21.co predicted that the market for tokenized assets could grow to as large as $10 trillion by the end of the decade.

Potential for RWAs to Become a New Asset Class

As more real-world assets are tokenized and made available we may see the emergence of RWAs as a distinct asset class. This would provide investors with new opportunities to diversify their portfolios and gain exposure to a wide range of physical assets, from real estate and precious metals to art and collectibles.

The growth of RWAs as an asset class could also lead to the development of new financial products and services, such as RWA-backed derivatives, exchange-traded funds (ETFs), and indices. These products would further enhance the liquidity and accessibility of real world assets, attracting more investors and driving adoption. Tokenized treasuries have been leading the charge, with the total value of tokenized treasuries in circulation growing from around USD $700 million to $1.3 Billion as of May 2024 according to rwa.xyz.

Expected Growth and Adoption

The market for tokenized real-world assets is expected to grow significantly in the coming years, driven by factors such as increasing institutional interest, regulatory clarity, and technological advancements. As more investors recognize the benefits of RWAs, we can expect to see a surge in demand for these assets. On-chain protocols have also started to take an interest in RWAs, such as the Avalanche Foundation’s commitment to invest $50 million in tokenized physical assets created on Avalanche.

The adoption of RWAs is likely to accelerate as the infrastructure and ecosystem around these assets continue to mature. This includes the development of more secure and efficient tokenization platforms, the emergence of specialized custody and insurance solutions, the growth of secondary markets for trading RWAs, and advances in De-Fi/DePIN technology.

Challenges and Considerations

Despite the immense potential of real world assets, there are several challenges and considerations that must be addressed to ensure the sustainable growth and adoption of this new asset class. These include:

- Regulatory clarity: The regulatory landscape for tokenized real-world assets is still evolving, and there is a need for clear guidelines and standards to ensure the protection of investors and the integrity of the market. Governments and regulatory bodies worldwide must work together to create a harmonized framework that promotes innovation while mitigating risks.

- Technical challenges: The tokenization of real-world assets requires robust and secure technical infrastructure, including reliable oracles for data input, tamper-proof smart contracts, and interoperable blockchain networks. Addressing these technical challenges will be crucial for ensuring the security and reliability of RWAs.

- Valuations and liquidity: Determining the fair value of tokenized real-world assets can be complex, particularly for illiquid or unique assets like art or collectibles. Developing standardized valuation methodologies and ensuring sufficient liquidity in the market will be important for building investor confidence and facilitating efficient price discovery.

- Education and awareness: As with any new technology or asset class, education and awareness will play a vital role in driving the adoption of Real World Assets. It is essential to provide investors, asset owners, and other stakeholders with clear and accessible information about the benefits, risks, and mechanisms of RWAs to help them make informed decisions.

As the Real World Asset space continues to evolve and mature, addressing these challenges and considerations will be crucial for unlocking the full potential of this innovative new asset class. With the right approach and collaboration between stakeholders, RWAs have the potential to transform the global financial landscape, creating a more inclusive, transparent, and efficient marketplace for investors and asset owners alike.